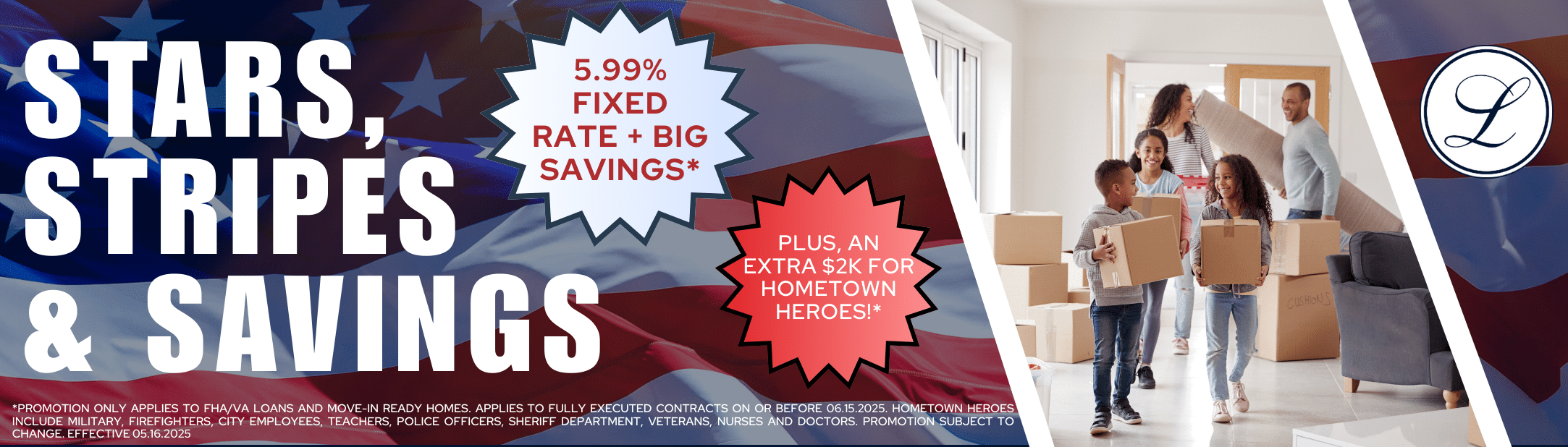

Texas-Sized Freedom. Memorial Day Savings. Contract by June 15.

LIMITED TIME OFFER EXPIRES IN:

Move in within 30 days

Builder-paid closing costs

Fixed 5.99% rate with preferred lender

Skip the build wait — start living now

What You’ll Feel on Closing Day

Relief — predictable payment, zero surprise fees.

Pride — a brand-new home you truly own.

Control — move tomorrow or design every detail.

Savings — thousands kept in your pocket.

Schedule A Tour Before June 15

A Community Expert will:

Reserve your home or homesite.

Secure your closing-cost coverage and flex credits.

Connect you with a preferred lender to lock the 5.99 % rate—all before the deadline.

Disclaimer:

Promotional incentives, including the 5.99% fixed interest rate and flex credit offers, are only available on select move-in ready homes and eligible homesites while inventory lasts. To qualify, buyers must enter into a purchase agreement by June 15, 2025. For move-in ready homes, the loan must close within 30 days of contract execution. Financing must be obtained through one of our approved preferred lenders. The advertised 5.99% fixed interest rate is available only on FHA and VA loan programs, and is subject to buyer qualification, lender approval, and specific program guidelines. All loans are subject to credit and underwriting approval. Not all buyers will qualify. Flex credit amounts and eligible uses vary by community and home series. Half-off lot premiums are available only on select homesites. Incentives, rates, terms, and availability are subject to change or termination at any time without prior notice. Additional terms and conditions may apply. Please see a Community Sales Manager for complete details.

Lillian Homes reserves the right to make any changes or discontinue any program, campaign, or incentive without notice or obligation. Home and community information, including pricing, included features, terms, availability, and amenities, are subject to change at any time without notice. Renderings, drawings, pictures, photographs, videos, square footage, floor plans, elevations, features, colors, and sizes are approximate for illustration purposes only and will vary from the built homes. Home prices refer to the base price of the house and do not include options or premiums unless otherwise indicated for a specific home. Incentives and seller contributions may require the use of certain lenders or title companies, some of which may be associated with Lillian Homes. Not all people will qualify for all offers. Promotional offers are typically limited to specific homes and communities and are subject to terms and conditions. Please visit a Lillian Homes sales consultant for additional information, disclosures, and disclaimers. All Images are for representational purposes only, the art and furniture are not a part of the purchase price.

6350 N. Interstate Highway 35E, Waxahachie, TX 75165

Lillian Homes is an Equal Housing Opportunity Builder